When retirement clocks in, a dynamic shift takes place in your life. The normal work life and regular paycheck routine you’re used to becomes a thing of the past. At this point in time, you as a retiree now have to depend on the pension funds you’ve received among other financial investments you may have to sustain yourself for the rest of your life.

Bills and other expenses are inevitable even after retirement. Knowing a few financial tips can help you keep your finances in check. Here are 5 tips to help you manage your finances upon retirement:

- Create A Spending Budget

Financial success is fully dependent on budgeting. Making a budget isn’t hard. With a piece of paper and a pen in hand, write down your main categories of spending and how much you spend on each.

Define the one-time large spend expenses such as asset purchases and the small recurring expenses such as daily house supplies. Ensure your budget caters for all these costs. With a budget in place, you’ll be able to track where every coin you spend goes.

- Embrace Simplicity As Much As You Possibly Can

Simplifying your finances will give you ease of managing your spend patterns. Close down all credit cards, have only one in place that you perform all your financial transactions on. Have one savings account and checking account.

Have all your investments under one trusted credible brokerage firm for easy tracking. Eliminate any subscriptions that add no value but require monthly payment fees. The simpler your financial structure is, the easier it is to manage it.

- Embrace Automation

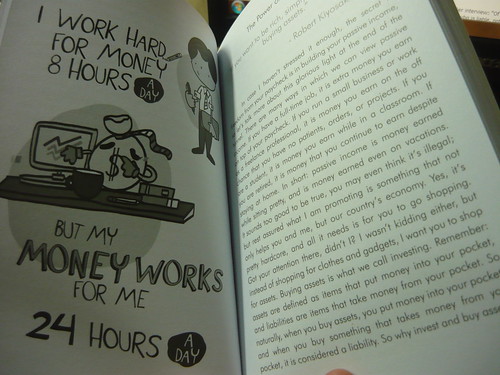

Automation allows you to manage your bills and track your financial investments online using the various electronic financial platforms offered by financial institutions.

With automation, you can access financial statements that underscore how much money you have and what you’ve spent. You can enable automatic bill payments which will save you the hustle of making trips to the bank. You can do this from your smartphone or computer.

Ensure that your passwords are secret and your logins are done from secure locations to avoid any unauthorized access to your accounts.

- Economize To Increase Savings

One of the biggest contributors to your spending expenses is a mortgage payment. Large mortgage payments can pose a huge risk to your retirement security. As a retiree, your aim should be to have low housing costs. You can opt for an affordable rental house or a paid-off home that is friendly to your pocket.

This not only applies to housing but other costs as well that may lead you to incur high expenditure. Economize and increase your savings.

- Establish A Health Cover

One of the things that majorly affects retirees and leaves them in a financial crisis is a sickness. In the event that a sickness arises, you may end up spending all your retirement money paying for medical expenses which makes the situation worse.

Having a health cover ensures financial security and peace of mind in the event of a sickness. Discuss with your local insurance provider and get advice on the best health cover available then enroll in it.

Conclusion

So there you have it. These 5 tips will help you manage your finances upon retirement. For more professional financial advice with regards to retirement, check out reliable Financial Services.

Retire gracefully and remember to always keep your finances in check.